Understanding the Exposure Draft of Ind AS 118: Presentation and Disclosure in Financial Statements

- GDV Consultancy

- Feb 13, 2025

- 2 min read

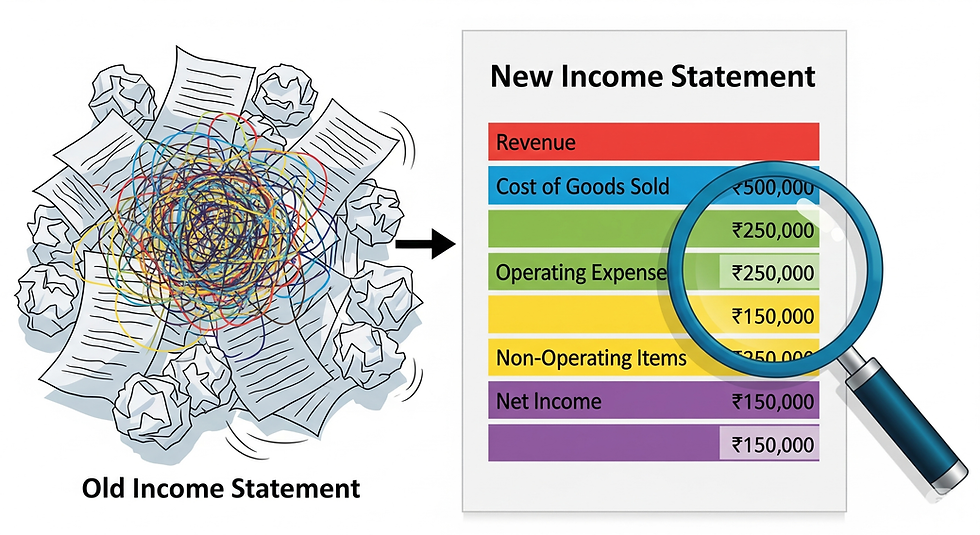

The Institute of Chartered Accountants of India (ICAI) has issued an Exposure Draft for a new Indian Accounting Standard (Ind AS) 118, titled "Presentation and Disclosure in Financial Statements." This standard is set to replace Ind AS 1, "Presentation of Financial Statements," and aims to enhance the communication of financial performance and position in financial statements. The proposed Ind AS 118 aligns with IFRS 18 and is expected to be effective for annual reporting periods beginning on or after April 1, 2027.

Key Objectives of Ind AS 118

The primary goal of Ind AS 118 is to improve financial reporting by establishing structured presentation and disclosure requirements. The standard focuses on:

Introducing defined subtotals in the profit or loss statement.

Mandating disclosures about management-defined performance measures (MPMs).

Enhancing aggregation and disaggregation requirements for improved clarity and comparability.

Major Changes and Requirements

1. Changes in the Profit or Loss Section

The introduction of two new mandatory subtotals:

Operating profit or loss

Profit or loss before financing and income taxes

Classification of income and expenses into five categories:

Operating

Investing

Financing

Income taxes

Discontinued operations

2. Expense Presentation and Disclosure

Companies must classify expenses based on nature (e.g., raw materials, salaries) or function (e.g., cost of sales, administrative expenses), or a combination of both.

Entities classifying expenses by function must disclose additional details, such as depreciation, amortization, and employee benefits, in the notes.

3. Management-Defined Performance Measures (MPMs)

Ind AS 118 introduces a definition for MPMs, which are performance measures disclosed by management in public communications outside financial statements.

Companies must provide a single note disclosure detailing MPMs, their reconciliation with Ind AS-defined totals, and explanations of their relevance.

4. Principles of Aggregation and Disaggregation

Entities must ensure that financial statements provide sufficient detail while avoiding excessive aggregation that may obscure important information.

Companies should group items based on shared characteristics and disclose disaggregated details in the notes where necessary.

5. Impact on Other Accounting Standards

Ind AS 7 (Statement of Cash Flows): Changes align with global amendments, ensuring uniform reporting of interest and dividends.

Ind AS 33 (Earnings Per Share): Only earnings per share (EPS) based on Ind AS 118-defined totals or MPMs can be disclosed.

Ind AS 34 (Interim Financial Reporting): Interim financial statements must include disclosures about MPMs.

Implications and Industry Response

The proposed changes are expected to enhance transparency and comparability in financial reporting. By requiring standardized presentation formats and clear disclosures, Ind AS 118 will help investors and stakeholders make informed decisions. However, companies may need to revise their internal reporting structures and ensure compliance with new disclosure requirements.

Comments