All you need know about Production Linked Incentive Scheme (PLI scheme)

- GDV Consultancy

- Apr 13, 2021

- 2 min read

Updated: Feb 1, 2022

About Production Linked Incentive (PLI)

Hon'ble Finance Minister, Smt Nirmala Sitharaman has announced an outlay of INR 1.97 Lakh Crores for the Production Linked Incentive (PLI) Schemes across 13 key sectors, to create national manufacturing champions and generate employment opportunities for the country’s youth. In addition to the three schemes announced earlier in March 2020, GoI has further introduced the following 10 new PLI schemes in November 2020.

Adding to the series of reforms is the announced production-linked incentive (PLI) schemes signaling a meaningful turn in India’s industrial policy.

The Basic premise on which the PLI schemes stands are as follows:

Outcome-based and result-oriented: This means that incentives will be disbursed only after production has taken place in the country.

Linking incentives to output: The calculation of incentives will be based on incremental production to be achieved at a high rate of growth. To achieve this incremental production, beneficiaries will be required to make additional investments in establishing green-field facilities or carrying out expansion of existing facilities.

Creating ‘champions’ to maximize impact: The scheme focuses on size and scale by selecting those players who can deliver on volumes. The targeted nature of the scheme will make it highly effective and the beneficiaries are likely to become globally competitive.

Cutting-edge technology, Integrate with global value chains: Selection of sectors has solely been based on its scope to cover cutting-edge technology, integrate with global value chains and create large-scale employment.

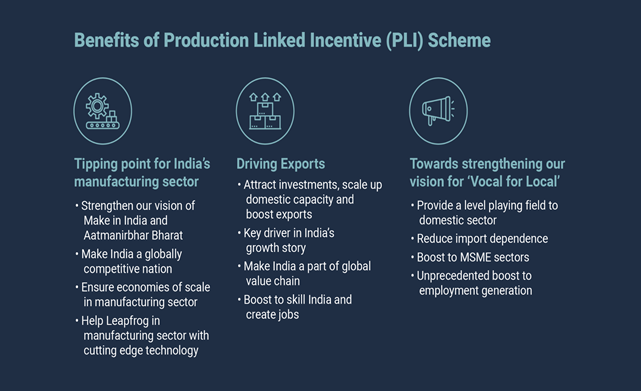

Benefits of PLI schemes:

Implementation of the schemes:

The PLI schemes provide eligible manufacturing companies incentives ranging from four to six percent on incremental sales over the base year for a four to six-year period. It is like a subsidy being provided by direct payment – as budgeted – for domestically manufactured goods by the chosen beneficiaries.

These schemes offer turnover linked incentives to approved investors, upon meeting the specified investment, capacity, and turnover criteria. Given their simple structure and the likely benefits, they have quickly become popular with businesses. There have been rapid developments on this front, with newer schemes being launched and some others nearing closure.

Which sectors are covered under India’s PLI schemes?

Sector | Outlay Rs Cr. | Incentive | Status (as Sept 2021) |

March 2020 | | | |

Part of 21940 | 5% to 20% for a period of 6 year | Closed | |

40000 | 4% to 6% for a period of 5 years | Closed | |

18420 | 5% for a period of 5 year | Closed | |

November 2020 | | | |

7325 | 1% to 4% for a period of 4 years | Closed | |

Department of Pharmaceuticals: Pharmaceuticals drugs | Part of 21940 | 3% to 10% for a period of 6 years | Closed |

12195 | 4% to 7% for a period of 5 years | Closed | |

10900 | 4% to 10% for a period of 6 years | Evaluation Stage | |

6238 | 4% to 6% for a period of 5 years | Open | |

4500 | Based on sales, performance criteria, and Local value addition for a period of five years | Closed | |

57042 | Based on sales, performance criteria, and Local value addition for a period of five years | Evaluation Stage | |

18100 | Based on sales, performance criteria, and Local value addition for a period of five years | Open | |

10683 | Based on sales, performance criteria, and Local value addition for a period of five years | Open | |

Ministry of Steel: Specialty Steel | 6322 | 4% to 12% for a period of 5 years | Open upto 29 March 2022 |

September 2021 | | | |

120 | Based on sales, performance criteria, and Local value addition for a period of five years | To be Announced |

Step of Process of Scheme: To Be Announced > Announced > Open Application > Evaluation Stage > Close Application

Comments