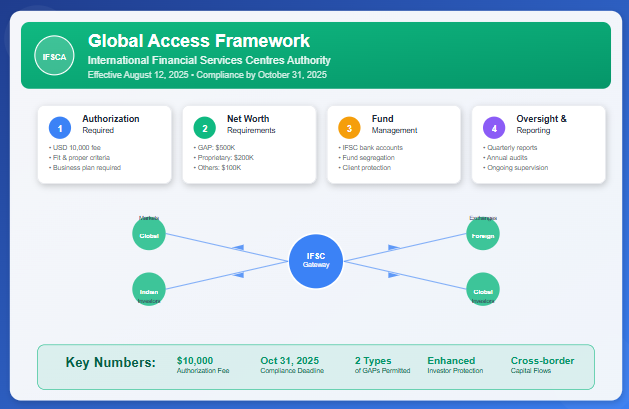

IFSCA Unveils Comprehensive Global Access Framework for IFSC: A Gateway to International Financial Markets

- GDV Consultancy

- Aug 13, 2025

- 3 min read

The IFSCA has revolutionized cross-border capital flows by introducing a comprehensive regulatory framework for Global Access Providers (GAPs) operating within India's International Financial Services Centres. This landmark circular, effective August 12, 2025, positions the IFSC as a strategic gateway connecting Indian and global financial markets while ensuring investor protection and regulatory compliance.

Key Regulatory Changes

New Authorization Requirements

The framework introduces mandatory authorization for all Global Access Providers, with existing operators required to comply by October 31, 2025. This represents a significant shift from the previous voluntary registration system to a more structured regulatory approach.

Enhanced Capital Requirements

The new framework establishes tiered minimum net worth requirements:

Full-service GAPs: USD 500,000

Proprietary-only GAPs: USD 200,000

Other Broker Dealers: USD 100,000

These requirements must be maintained separately from other business activities, ensuring dedicated capital allocation for global access operations.

Eligible Participants and Client Categories

Global Access Providers

The framework recognizes two primary categories of GAPs:

Subsidiaries of Recognised Stock Exchanges established in the IFSC

Broker Dealers with direct arrangements with foreign brokers for client or proprietary trading

Permitted Client Base

Global access services are available to:

Indian Residents: Subject to Foreign Exchange Management Act (FEMA) provisions and Liberalised Remittance Scheme limits

Non-Indian Residents: As permitted under FEMA regulations

Product Scope and Restrictions

Permitted Products

GAPs can provide access to all financial products listed on foreign stock exchanges, provided they fall within the IFSC's definition of "financial products."

Notable Exclusions

The framework explicitly prohibits access to:

Crypto-assets and crypto-backed instruments

Index derivatives available on IFSC exchanges

Single stock derivatives traded in the IFSC

Bond derivatives offered domestically

USD-INR/INR-USD derivatives available in the IFSC

Operational Infrastructure and Compliance

Fund Management Requirements

The new framework mandates strict fund segregation:

All client funds must be routed through IFSC bank accounts

Separate accounts for global access and IFSC activities

Client funds must be segregated from proprietary trading funds

All banking relationships must be with International Banking Units in the IFSC

Data Governance

GAPs must maintain all user, transaction, and trade data within the IFSC, ensuring regulatory accessibility and compliance with data localization requirements.

Risk Management Framework

The circular emphasizes robust risk management systems, particularly for client-facing operations, with comprehensive internal controls to protect investor interests.

Enhanced Disclosure and Transparency

Mandatory Client Disclosures

GAPs must provide comprehensive written disclosures covering:

Risk factors associated with global market investments

Detailed fee structures and charges

Custody arrangements and account structures

Tax implications and regulatory requirements

Investor protection limitations

Website Requirements

All GAPs must maintain dedicated webpages providing detailed information about global access arrangements, ensuring transparency for prospective clients.

Regulatory Oversight and Reporting

Compliance Framework

The framework establishes multiple oversight layers:

Quarterly reporting to IFSCA

Annual independent audits by qualified professionals

Ongoing supervision by recognized stock exchanges (limited to trading activities)

Authority-appointed inspections when necessary

Fee Structure

The new framework introduces a comprehensive fee structure:

Authorization Fee: USD 10,000

Recurring Fees: Based on turnover with different rates for derivatives (0.000075%) and other products (0.005%)

Fees apply to both proprietary and clientele trading activities

Strategic Implications

Market Development

This framework positions the IFSC as a sophisticated financial hub capable of facilitating seamless global market access while maintaining regulatory integrity. The structured approach is expected to attract institutional investors and enhance India's role in international capital flows.

Investor Protection

The comprehensive disclosure requirements, fund segregation mandates, and enhanced oversight mechanisms demonstrate IFSCA's commitment to investor protection while fostering market development.

Compliance Timeline

Existing operators have a clear compliance timeline with the October 31, 2025 deadline for authorization, website updates, fund routing compliance, and risk disclosure implementation.

Industry Impact and Future Outlook

The new framework reflects IFSCA's evolution from a developing regulatory authority to a mature financial services regulator. By establishing clear operational guidelines while maintaining flexibility for innovation, the framework balances regulatory oversight with market development objectives.

The emphasis on technology infrastructure, data governance, and cross-border compliance positions the IFSC to compete effectively with established international financial centers while maintaining India's regulatory standards.

Conclusion

IFSCA's comprehensive global access framework represents a significant milestone in India's financial services evolution. By establishing clear regulatory parameters while facilitating international market access, the framework creates a robust foundation for the IFSC's growth as a global financial gateway.

The October 31, 2025 compliance deadline provides existing market participants sufficient time to align their operations with the new requirements, while the structured approach ensures sustainable market development with appropriate investor protections.

This regulatory advancement positions India's IFSC as an increasingly attractive destination for international financial services, potentially accelerating cross-border capital flows and enhancing India's integration with global financial markets.

Comments