The Dawn of a New Era in Financial Reporting: Navigating IND AS 118

- GDV Consultancy

- Aug 9, 2025

- 4 min read

The landscape of financial reporting is on the brink of a significant transformation with the upcoming adoption of IND AS 118: Presentation and Disclosure in Financial Statements. This new standard, which aligns India's reporting framework with IFRS 18, is set to fundamentally reshape how your company communicates its financial performance. It's more than a mere accounting update; it's a strategic imperative that demands proactive planning and a re-evaluation of your financial narrative.

This article outlines the core changes under IND AS 118, the strategic implications for a large, listed company like yours, and a roadmap for successful implementation.

The Big Picture: What's Changing?

Effective for annual reporting periods beginning on or after April 1, 2027, IND AS 118 replaces the existing IND AS 1 and introduces a new, highly structured approach to financial statement presentation. The core objective is to provide investors and other stakeholders with more transparent, comparable, and useful information about a company's performance. The key changes are as follows:

1. A Structured Statement of Profit and Loss 📊

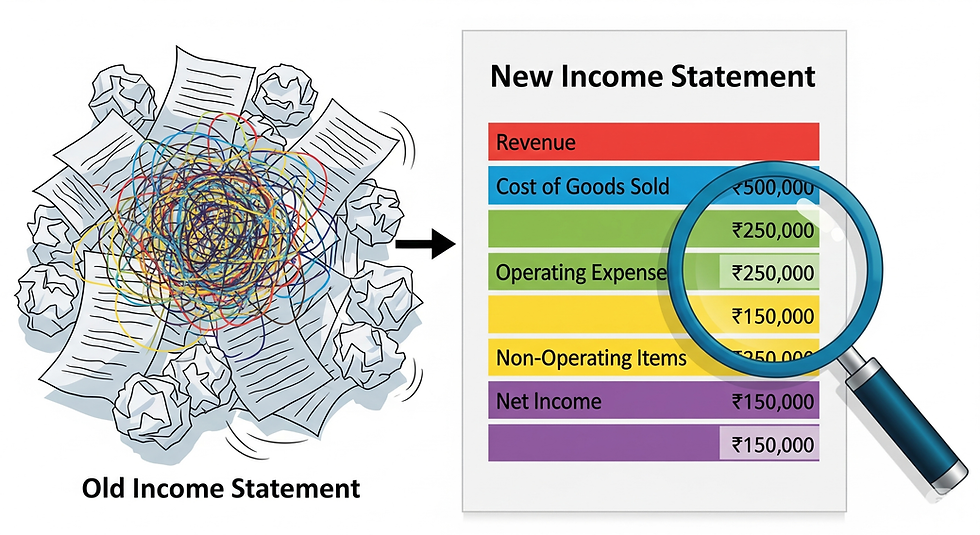

Gone are the days of a free-form income statement. IND AS 118 mandates a clear, five-category classification for all income and expenses:

Operating: This category captures the core earnings and costs from a company's primary business activities.

Investing: Items here relate to income and expenses from investments that are not the company's main business (e.g., gains on sale of investment property, interest income).

Financing: This category includes income and expenses related to how a company funds its operations (e.g., interest expense on debt).

Income Taxes: A dedicated section for all tax-related expenses.

Discontinued Operations: For income and expenses from a component that has been disposed of or is held for sale.

This new structure will require a meticulous review of your chart of accounts to correctly categorize every single line item.

2. Mandatory Subtotals for Enhanced Comparability

To standardize the evaluation of financial performance across different companies and industries, IND AS 118 requires two new subtotals on the face of the Statement of Profit and Loss:

Operating Profit or Loss: This is a crucial, standardized metric that reflects the total of all income and expenses in the operating category. It provides a consistent measure of core operational performance.

Profit or Loss Before Financing and Income Taxes: This subtotal is the sum of operating profit and all items from the investing category.

These subtotals will force a re-evaluation of any existing "EBIT" or "EBITDA" metrics your company currently uses.

3. Formalizing Management-Defined Performance Measures (MPMs)

This is perhaps the most significant change for listed companies. If your company uses non-IND AS performance metrics (often called "non-GAAP measures" or "adjusted profit") in your earnings releases, investor presentations, or other public communications, IND AS 118 requires you to:

Disclose all such MPMs in a single, dedicated note within the audited financial statements.

Provide a clear definition, a rationale for why the measure is useful, and a detailed reconciliation to the most directly comparable IND AS subtotal.

This change brings an unprecedented level of scrutiny and governance to these metrics, essentially making them part of the auditable financial statements.

4. Clearer Aggregation and Disaggregation Rules

The standard provides robust guidance on how to group or disaggregate information. The core principle is that material information should not be obscured. Items currently lumped into "Other income" or "Other expenses" will need to be carefully reviewed and disaggregated if they are individually material. This will lead to more informative disclosures and fewer ambiguous line items on the face of the statements.

Strategic Implications and Implementation Roadmap

For a complex, listed company, the transition to IND AS 118 is a major project that requires cross-functional collaboration and a well-defined strategy.

1. Systems and Processes

You will need to update your Enterprise Resource Planning (ERP) and reporting systems to support the new categorization. This involves:

Mapping every revenue and expense account to the new IND AS 118 categories.

Redesigning your financial reporting templates for both annual and interim reports.

The standard mandates retrospective application, meaning you must restate your financial statements for the prior reporting period (e.g., FY 2026-27 will be presented in the new format in your FY 2027-28 report). This is a significant undertaking that requires careful planning.

2. Communication and Investor Relations

This is a prime opportunity to refine your financial narrative.

Proactive Communication: Engage with your IR team to plan how you will communicate the new financial statement format to investors and analysts. Explain the rationale behind the changes and how the new "Operating Profit" metric aligns with your company's core performance drivers.

Review all public disclosures: Ensure that all non-IND AS metrics used in external communications are clearly defined and reconciled as per the new standard's requirements.

3. Internal Controls and Governance

The inclusion of MPMs in the audited financial statements requires a new level of governance. You must:

Formalize the definitions and calculation methodologies for all MPMs.

Establish internal controls to ensure the accuracy and auditability of these metrics.

This is a critical step to ensure that your financial disclosures remain credible and stand up to auditor scrutiny.

4. Transition Timeline ⏳

Given the April 1, 2027, effective date, here is a recommended action plan:

Now - 2026: Conduct a detailed gap analysis. Identify all required changes to your systems, chart of accounts, and MPMs. Begin drafting a project plan for the implementation.

Q4 2026 - Q1 2027: Run a parallel reporting cycle. Prepare "shadow" financial statements under the new IND AS 118 framework to identify and resolve any issues before the mandatory implementation date.

April 1, 2027, onwards: Implement the new standard. This will require the retrospective restatement of your comparative financial statements.

By viewing IND AS 118 not as a compliance burden but as an opportunity to enhance the clarity and usefulness of your financial reporting, you can ensure a seamless transition and strengthen your company's communication with the market.

Comments